The New York Stock Exchange is witnessing a surge in young talent recently. Among them, emerges Andy Altahawi, a rising star making waves with his daring strategies .

His track record highlights a sharp knowledge of the market, and his moves have consistently produced impressive profits. Whether he can maintain this trajectory remains a matter of speculation, but one thing is clear: Andy Altahawi is a name to keep an eye on in the ever-evolving world of finance.

The impact of Altahawi on the NYSE Market

Altahawi's Company Goes recent involvement in the NYSE market has had a significant impact. His decisions have shifted the landscape of trading, leading to heightened movement in certain sectors. Experts are analyzing his approach closely, as they attempt to gauge the long-term ramifications of Altahawi's influence on the market.

Examining Andy Altahawi's NYSE Portfolio

Unveiling the strategic composition within Andy Altahawi's portfolio listed on the New York Stock Exchange (NYSE) presents a fascinating insight for both seasoned investors and novice market enthusiasts. By delving into his concentrated selection of stocks, we can glean valuable perspectives about his investment approach.

- Moreover, analyzing the movements of these securities over time can shed light on Altahawi's market outlook.

- Concurrently, understanding the fundamental factors influencing his selections can provide crucial insights into the broader investment trends.

Consequently, this in-depth investigation aims to uncover the nuances of Altahawi's NYSE portfolio, offering valuable wisdom for analysts seeking to navigate the dynamic world of financial markets.

NYSE Insider: Unpacking Andy Altahawi's Moves

Andy Altahawi recently finds himself at the center of analyst attention as his strategic moves on the NYSE floor continue to generate intrigue. Altahawi, known for his gutsy approach, has been executing a series of noticeable trades that have sent ripples through the market. Some speculate he's leveraging on a pending shift in the market, while others believe his actions are motivated by a desire to gain influence. With Altahawi's history of innovation, it remains to be seen what his ultimate objective is, but one thing is certain: his trajectory is one to watch closely.

Andy Altahawi and the Future of NYSE Trading

Andy Altahawi's arrival on the New York Stock Exchange has been nothing short of remarkable. His approaches for the future of trading are both ambitious, poised to revolutionize the industry landscape. Altahawi's focus on innovation is evident in his initiatives to streamline the trading experience for both participants.

- Furthermore, Altahawi emphasizes the importance of fairness in the market. His commitment to governance is crucial in building a robust financial ecosystem.

- Under Altahawi's direction, the NYSE is poised to remain as a global center for capital. His dedication to the future of trading is inspiring and sets a ambitious standard for the industry.

Transforming with Altahawi : Transforming the NYSE Landscape

The NYSE panorama is experiencing a profound transformation as the pioneering Altahawi Effect takes hold. Fueled by cutting-edge technology and a visionary approach, Altahawi is redefining the way traders function. This transformative effect is creating new opportunities and obstacles, forcing a accelerated evolution within the time-honored financial domain.

The impact of Altahawi is noticeable in multiple facets of the NYSE environment.

* Algorithmic trading has expanded, optimizing efficiency and speed.

* Financial modeling plays a pivotal role in informing decision-making, leading to enhanced accuracy and insights.

* copyright integration are gaining mainstream adoption, transforming the boundaries of traditional finance.

The Altahawi Effect is not without its complexities. Regulatory frameworks are evolving to keep pace with this rapid evolution, while concerns regarding market manipulation remain paramount.

Despite these complexities, the Altahawi Effect represents a driving force for growth and progress within the NYSE. Traders who adapt to these transformative changes are poised to succeed in this evolving landscape.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Tia Carrere Then & Now!

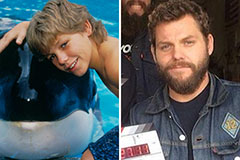

Tia Carrere Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!